Annual salary calculator with overtime

Federal lawspecifically the Fair Labor Standards Act FLSArequires any salaried employee making less than 47476 per. Overtime Weekly Pay Hourly Wage x 15 x Overtime Hours.

The 15 Best Salary Calculators To Help Achieve Fair Pay The Salary Project

8000 6000 14000.

. Multiply the quantity of hours you figure per week via your hourly wage. If you make 75000 a year your hourly wage is 750002080 or 3606. Depending on the employer and its incentive policy the overtime multiplier may be greater than.

If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10. Overtime Hourly Wage. This gives the exact amount you earn yearly.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. See where that hard-earned money goes - Federal Income Tax Social Security and. Enter your info to see your take home pay.

A non-workman earning up to 2600. Average annual salary 15 x 15 x 52 11700. The Homebase Overtime Calculator for Wage Rates More.

1000154 1500 4 6000. Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every. If you worked 55 hours in a week your overtime.

To calculate your average annual salary you would multiply 15 hours a week by 15 dollars an hour. Then multiply that by 52 weeks. If your Annual Salary is 50000 and you work 40 HoursWeek or 2088 HoursYear your Hourly Rate 50000 2088 2395.

For instance if a grocery store hires cashiers for an hourly rate of 1500 per hour on a full-time schedule of 40 hours a week you can calculate the annual pre-tax salary by. The FLSA requires that covered nonexempt employees in the United States be paid at least the Federal minimum wage for all hours worked and receive overtime pay at one and one-half. 57 rows How to Calculate Annual Salary.

Multiply that variety by fifty two the variety of weeks in 12 months. 10 x 40 hours 400 base pay. Overtime Hours The amount of hours worked above-and-beyond 40.

Hourly Rate Bi-Weekly Gross HoursYear Example. Wage for the day 120 11250 23250. This workers total pay due including the overtime premium can be calculated as follows.

Ad Quickly determine fair compensation for 7000 jobs 1000 industries. If you work 375 hours a week divide your annual. Dont forget that this is the minimum figure as laid.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. Overtime pay of 15 5 hours 15 OT rate 11250. 15 x 6 overtime hours 90.

To determine your hourly wage divide your annual salary by 2080. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

10 x 15 15 overtime rate of pay. Regular pay of 15 8 hours 120.

Salary Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

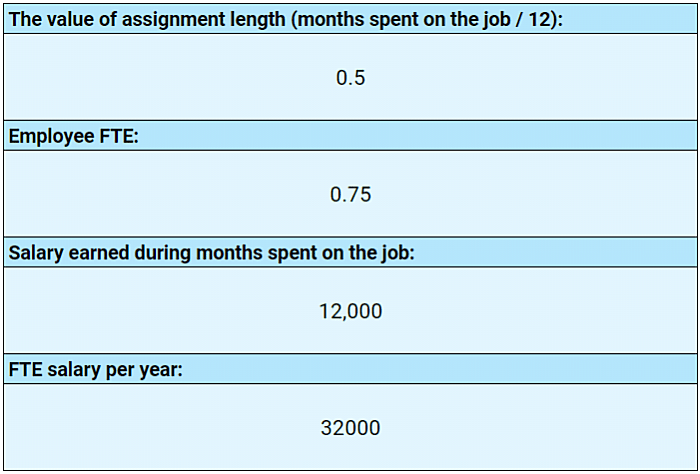

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

Annual Income Calculator Calculator Academy

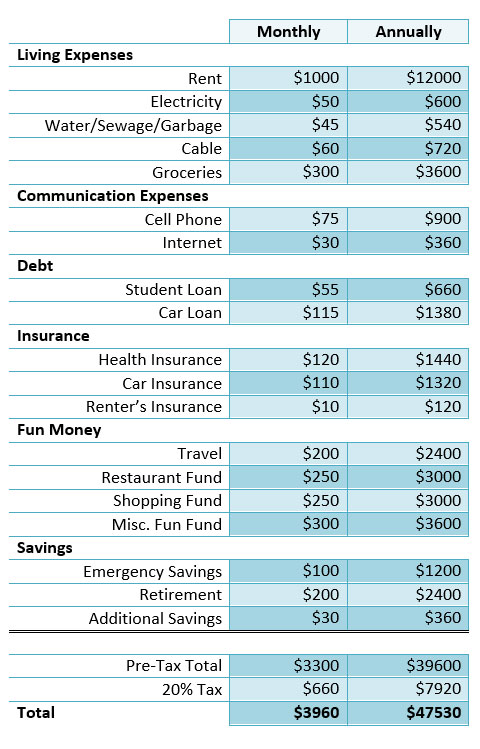

How To Calculate How Much You Need To Earn

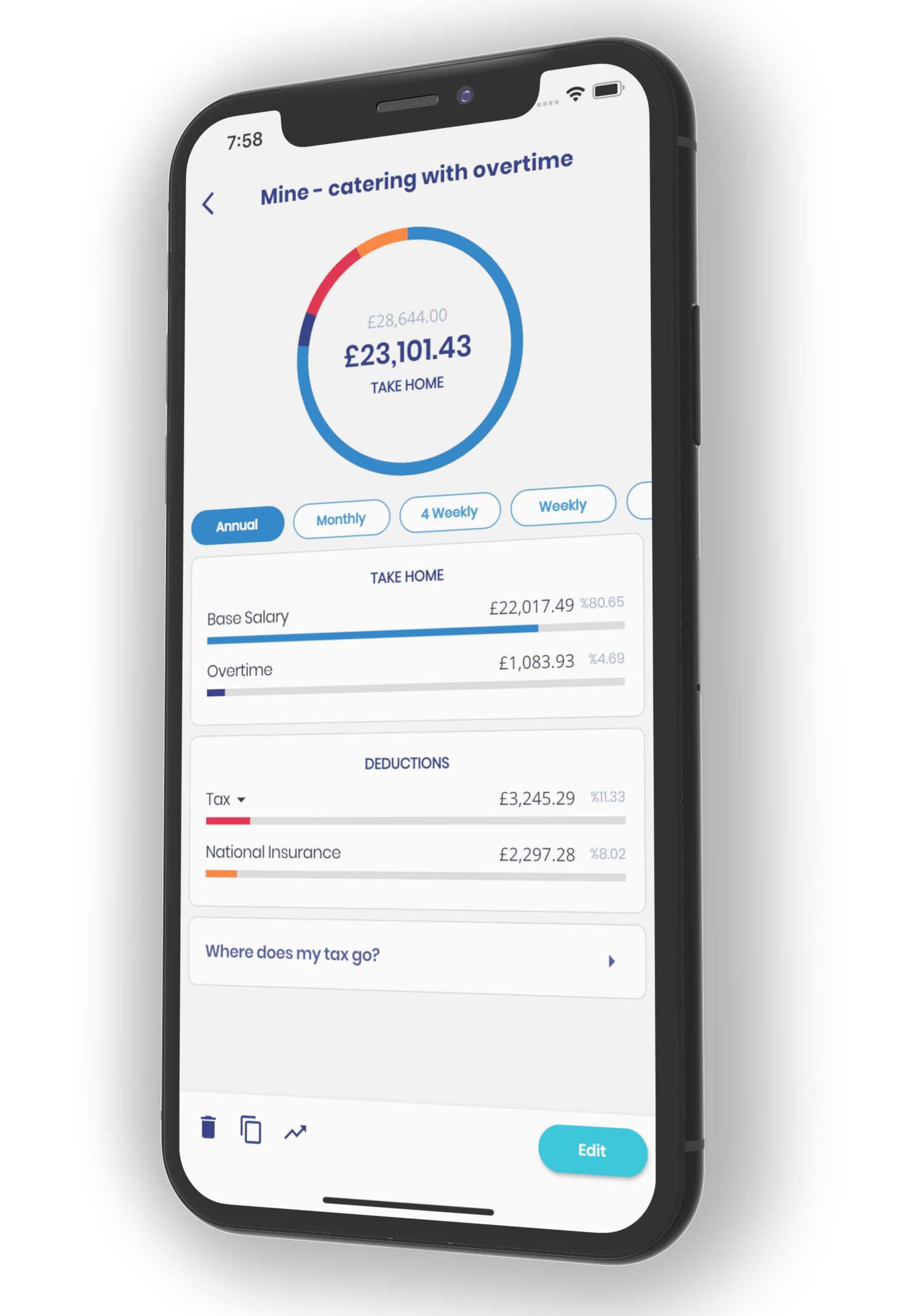

Salary Calculator App

How To Calculate Employee Salary In China China Payroll

Salary Calculator Designs Themes Templates And Downloadable Graphic Elements On Dribbble

Salary Calculator Singapore App Development App Development Companies Mobile App Development Companies

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Exercise 1 Build A Salary Calculator In Python

Overtime Calculator

What Is Annual Income How To Calculate Your Salary

Salary Calculator Career Resources

4 Ways To Calculate Annual Salary Wikihow

Netherlands Hourly Rate Tax Calculator 2022 Hourly Rate Sa

The Salary Calculator Apps On Google Play